Other outside experts like FTR offer these intermodal points

FTR Transportation Intelligence experts predict that over roughly the next two months, all international traffic will remain weak due to global supply chain disruptions.

The upside? FTR’s CEO Eric Starks described this week how some supply chains will see imported inventories turn from a surplus on-hand to a need for replenishment. That then could generate added rai- hauled replacement intermodal traffic.

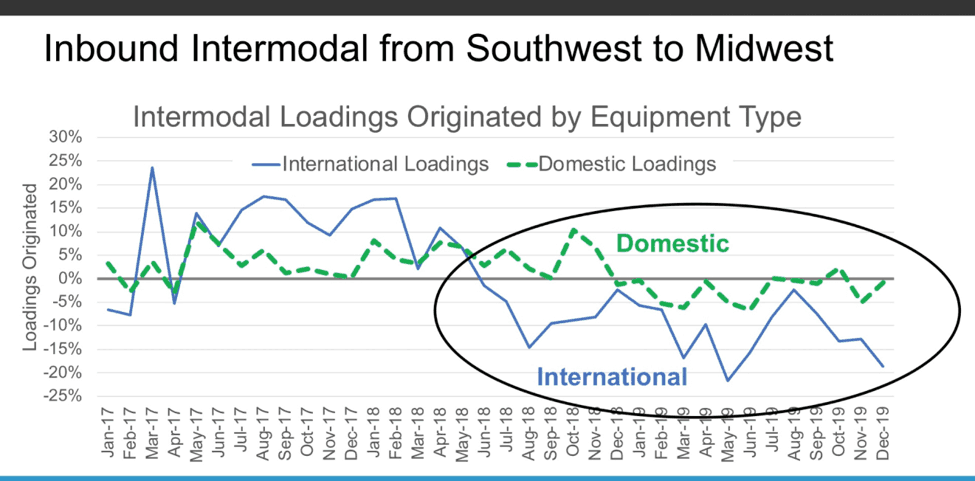

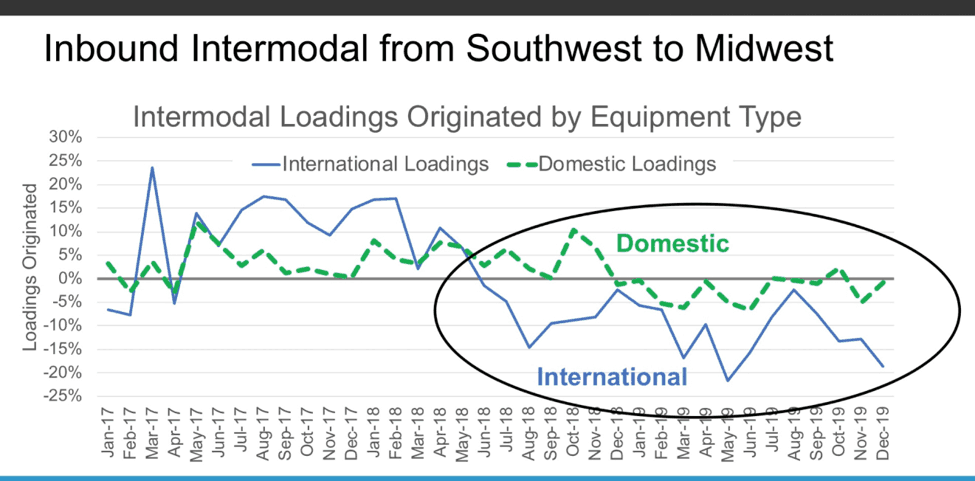

In this graphic, Starks points out how rail’s intermodal market share has stalled recently compared to trucking’s share in the long-distance lanes. In part, this FTR graph uses source data from the Intermodal Association of North America. The domestic 53-foot containers by rail are slightly negative as shippers are necessarily using rail as the first mode choice over the past year. And international maritime 40-containers are dropping on a percentage basis. Some of this pattern involves complex transloading logistics decisions by shippers – and shifts are based on lower spot rate truck pricing. Clearly, intermodal rail faces dynamic competition.

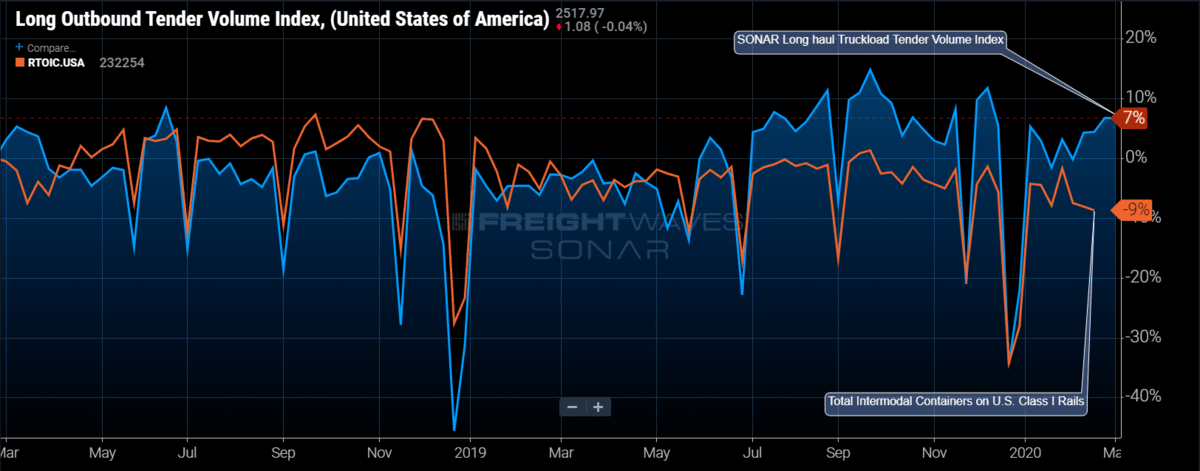

In addition, FreightWaves SONAR has a similar chart. It also illustrates that intermodal has lost share to long-haul trucking.

Meanwhile, there are many stored intermodal cars… like these in the southern California desert.

The downside risk is that if the coronavirus is not contained by mid-summer there may be no uptick in intermodal rail traffic volume for the year over the total intermodal units moved in 2019.

Therefore, intermodal year-over-year could be negative by the end of the year. This is not a prediction; just a heads-up alert.

There are other market opportunities for the railroads beyond intermodal. There are solid carload traffic growth opportunities. The growth of railway freight need not depend solely upon intermodal.

Rod Case, a senior partner at Oliver Wyman, pushed an alternate theory this week at La Quinta, California, before about 400 financial investors and freight car experts. He suggested that selected carload traffic might actually represent a superior opportunity for securing rail freight growth. I will cover those carload opportunities in an upcoming commentary. A number are very probable prospects.

Instead of intermodal? Yes.

As a final alert, the smart play for railroads and intermodal partners is to realize that volume and car requirement cycles are a normal part of business decisions. An excess inventory of intermodal cars isn’t a good business strategy. However, there is a surplus of both trailer-on-flatcar (TOFC) as well as stack-container platform cars. Not a huge excess, but noticeable from a financial perspective.

How long might it take to work that surplus off? Sucik is my go-to guy. He thinks maybe 12 to 18 months. It’s hard to say. Readers – your contrary views are important. Please offer your thoughts.