Greetings;

I have had some periodic IT issues so this is a bit jumbled, several issues in one piece.

First, RailTrends is a live-go – check it out www.railtrends.com and attached – it will be so great to live

and in person! See semi-final agenda, attached….Speaking of which, I was doing the same the last three

weeks, speaking 5X at three major and successful industry events, NARS (covered; attached).

Second, RR Earnings start tomorrow, or today when you might read this (CN, who is parsing the TCI

statement as we write – see below - where the CALL is so much more important than the numbers – and

THAT is likely the theme for the rail group given the Supply Chain issues and tough-er comparisons); 5/6

the report in this action-packed week so stay tuned….Rails may modestly underperform the overall markets.

The S&P 500 earnings consensus is for 28% growth, while the rails come in at +27% - that includes the US

large carriers at +18% and KSU, whose last earnings call won’t be their best (estimates at +4% EPS YOY).

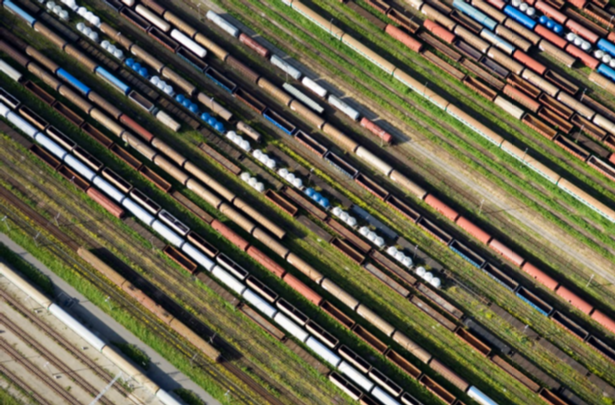

Some thoughts on the quarter, where we saw fire (PNW, BC) and rain (Louisiana) and stacks of

containers we thought might never end. The quarterly calls will be all about congestion and service

(recovery), resilience, JIC, fuel surcharge lags, labor availability, and, I hope and expect, a return to the

investment themes that were emerging pre-pandemic, Growth/Technology/ESG, themes that are a good

answer to regulatory worries….early related earnings have been spotty – we know about autos (GM’s

sales down a third in the quarter) and the parcels (FDX’s relatively poor showing). JBHunt was

something else again – a big “win” overestimates but coming despite underperforming on both

intermodal volumes, down 6%, and in operating efficiency (yields were up 24%).

Traffic isn’t helpful. How much is due to congestion? North American volume showed winners in 12/20

carload categories. US coal was up 14%! But US grain and autos were down 15% and 28%; for Canada,

those figures were -20% and -41%!). Overall, September dropped 2.6% (that’s carloads up 2.3% and IM

down 6.8%). IANA’s slightly different (more inclusive of the IM ecosphere) showed a similar overall

drop, domestic down 8% and international down 6%. September was a real drag. US volumes showed a

just under 5% gain in Q3 carloads, a 3.3% drop in IM; Canada For the US (thanks Roy) BNSF showed Q3

volume growth (see my “Consideration of BNSF” in RailPrime) of 4%, CSX 2%, NS and UNP both dropped

1% YOY - BNSF’s IM growth of 2% and CSX’s of 3% compared to their rivals dropping 7% and 5%

respectively. Mexican intermodal declines of 12.6% remain worrying.

From the Tweets, from earlier, in chronological order:

- CP got re-approval – why necessary? – on a 4:1 STB vote (Primus) on CP’s Voting Trust for KSU,

under Old Rules, still requiring “true independence”(via Mr Starling) & financial viability (CP

didn’t increase leverage)/It’s the only CPKC act that somehow flew under the radar…. - Congrats to my Twitter host Commtrex for the innovative deal signed with KCS to link up

transport opportunities (i.e.; a nice response to the STB on Growth!) for shippers in the US &

Mexico (and soon - the upper Midwest and Canada - nice timing!) - The Biden-assisted move of Port-LA to join POLB & go 24/7 is helpful (& about time) but NO

silver bullet – the shortage of workers (dock/warehouse/drayage/truck/receiver & rail) as well

as of chassis are bigger issues….time (24/7 and post-peak/ 2022) is the only solution - Speaking of POTUS, a big MEA CULPA from me on making one assumption – that a Biden

administration would (fully) restore trade sanity….despite calls from industry (and the US

Chamber etc) the $370B in tariffs remain

TCI vs CNI - The big fight Is this the return of - or last stand of the Cult of the OR? Who best runs the

modern railroad, Operations, or Marketing (see Foote/Rose/Farmer)?

The first two rounds were TCI jab and CNI defending – Round one was the Letter and the announcement

of Vena and the Gang of Four (Board nominees). Round 2: This wasn’t the expected scenario - It’s CN

jabbing back at TCI citing “inconsistencies” and “misleading claims” (noting the somehow generally

ignored fact that TCI is a/the major holder in both CN & CP – CN: it’s a “glaring conflict of interest”) CN

also more cogently IMHO defended their growth-over-margin Plan. At the time I thought: It’s early

rounds….this may well get bloody.

Round Three started today - TCI finally dropped their battle plan for CN to support the long activist proxy

campaign towards the 3/22/22 CNI “Special Shareholders Meeting” - see www.CNbackontrack.com for

the 102(!) page deck - which had some good points, including a public backing of growth over OR (“the

outcome”) although low cost and ops-focus was a theme. TCI, like CP in their political fight for KCS, has

reacted smartly to Street and DC (etc) discussion. Now, we await CN’s response (Round Four) on their

call in the am. (And, Question: when did investing in PSR make one an inventor?)

Many had expected TCI & Jim Vena to target an OR of ~53% vs CNI’s (near-term 57%). But instead, TCI

was clever – they actually played Bugs Bunny instead of Daffy Duck, turning the tables and took CN to

task for their plans call for a reduction in OR to 57% as “short term”, and changed their cost-cutting,

margin focused strategy (as initially expressed in their letters and through their, well….allies on the sell-side) into one of growth. Slide 32 (Growth vs OR) is as good an expression of that theme (and rejection

of the Cult of the OR) as I have seen in a while, not written by me, anyway. Do they really believe it?

Will an operator believe the new religion more than a marketer? I must admit I haven’t fully reached a

conclusion here so here are some thoughts, first their 6-point plan as highlighted by a smart observer

(my first reaction was – this seems standard, almost universal – their “Four Priorities” are every

company’s):

TCI's six-point plan for sustainable, long-term growth:

- A low cost, high-service network will enable the CN marketing team to use competitive

pricing to win new business and take market share from trucks. - A reliable, high-service product offering will make CN a more attractive shipping

alternative for customers. - A more efficient cost structure will shorten the distance over which intermodal becomes

price competitive. - A reliable and precise schedule will free up network capacity for CN to offer more

frequent shipment options and departure times. - A more profitable business model will generate more cash for CN to invest in track to

connect new customers and shortline feeder railroads to CN's network.

- Capex: Higher cashflows can also be used by CN to relieve critical network pinch-points and

invest in technology to improve network capacity, velocity, and safety. The irony here is that CN

already does invest in technology (and TCI discreetly acknowledges that). Also, in discussion of

Capex, something that you might know is quite important to this analyst, TCI warns against

cutting Capex for share buybacks (taking a page from the STB playbook). But CNI’s Capex

reduction target for 2022 – which came off as a reaction in their announced Plan – is

also after years (3+) of massive “catch-up” investing (up to 27% of revenues) following a period

when of underinvestment. From 2013-2015 CN spent C$350mm on track capacity – and in 2016

(thanks Bill) that dropped to….$6mm. Managing that process was COO Jim Vena. - Also still spurious is the brain-drain-claim, and discussion of big damage done by losing out to CP

in the KSU fight, which I continue to believe they never could have one but I know that only in

retrospect (old vs new rules) - CN vs CP growth performance – at least some of this has to do with PSR life cycle. CP wasn’t

running well, Pershing Square & Ackman/Hunter & Creel came to the rescues but were

internally focused on operations, until the seminal “pivot to growth”. At various points CN was

winning business because they had accomplished PSR and CP was undergoing it; when the pivot

came some of that “natural share” returned to CP….Also remember - On the OR gap, I will reiterate my desire to see a true apples comparison (depreciation/non-rail

business impact, MIX impact, etc) - CN is acting on their cost-cutting plan - Shippers of CN’s downsizing freight-forwarding service

reportedly were surprised earlier this month by the (CN Worldwide) wind-down, but they surely

had some notice as CN said that freight forwarding would likely be closed and other ancillary

segments sold/spun or modified – on the 9/17 Investor/TCI defense call. The CN-WW/FF winddown is a sign they are moving forward in their defense and did buy some time as the

scheduling of a Special Meeting of Shareholders re: TCI at the end of Q1 of next year does allow

for time for both sides to present their case and meet with shareholders) - Does UP’s CEO Lance Fritz deserve any credit for their operating performance?

- On a serious note, TCI points out some issues of incentive/compensation:

- CN is the only railroad to not include OR in their plan….THAT IS A GOOD THING. The

way one keeps a cult alive is to pay people to provide for it…. - CN removed ROIC from the compensation plan in 2020. If that is true (and not, say, juts

a pandemic short-term reaction), THAT IS NOT SO GOOD.

- CN is the only railroad to not include OR in their plan….THAT IS A GOOD THING. The

CN’s response will be interesting and here’s hoping not overly defensive. Not only does the defensive

response have a poor track record (0 for 3 this century) but CN’s growth and Feed the Beast (FTB)

strategy should be owned and defended, allowing for clarity on the issues involved here….

Sad news: The railroads lost two important leaders, perhaps not as well-known as they should be,

because they rose to their heights in (essentially) private companies, one a short line legend, “Jake”

Jacobson of the Pioneer Valley and the other, shockingly and way too young, John Miller, Group VP for

Industrial Products at the BNSF. RIP….

Also (and this is the back-up from my server issues):

- Class 8 truck orders dropped 12% YOY in September….a puzzler

- The White House and the TSA will be imposing cyber-security rules on freight rails soon

- Union Pacific, in the form of RailTrends speaker and CMO Kenny Rocker, said they were in a

short shot clock in terms of considering Rail Pulse (also an RT21 presenter)…. - The proxy advisor Glass Lewis advised BHP shareholders to vote down their proposed “Climate

Transition Action Plan” (CTAP) saying it has “limited scope, definitions, and goals”. This has

broader ESG, coal – and rail implications…. - And the SEC is going after the passive investment fund/proxy advisor relationship, issuing

proposals for more transparency (this also has broad implications for rails) - NSC is collaborating with Progress Rail/EMD on a Tier 4 switching loco, joining the list of rails

working on their own emissions/power issues - The STB taketh shots at the railroads but also giveth some praise on occasion: Chairman

Oberman (RT21 Presenter) noted his pleasure at visiting two NSC Chicagoland facilities and

called the less-than-carload experiment helmed by NS’s head of merchandise “a step in the right

direction” – high praise indeed. Note – and you guessed it – Elkins is also an RT21 presenter…. - My RT21 partner Progressive Railroading announced their Rising Stars, and amongst the Class

One rails the score was UNP and KSU 3 each, CSX, CNI and CP, two, BNSF one. Shortline stars

came from RJ Corman, Pioneer, and Watco…. - KCS announced that EVP-PSR Sameh Fahmy would be leaving at year-end; there will be a drink

raised at RailTrends to the irrepressible SF…. - AMLO is interfering in the energy markets again down south….and up here, Goldman is calling

for $90 oil - While UP says that the all-in cost of its wildfires in the PNW (including massive re-routing and

additional miles) was north of $100mm – meanwhile, CP and CN were both exonerated of any

role in the wildfires in BC - I guess it wasn’t jobless benefits that were holding back job creation after all?

- Ode to the dying of the Blackberry, for those of you who give me grief for my choice of device

(it’s a tool, not a toy): https://on.ft.com/39VJf3f

Yeah, we know that there are supply chain issues! We’ll cover this more along with the earnings:

- Covid pandemic is not the supply chains’ only problem - Washington Post; 70% of the S&P 500

companies that have reported so far have mentioned “supply chain”

Anthony B. Hatch

abh consulting

http://www.abhatchconsulting.com

abh18@mindspring.com

Twitter @ABHatch18