Rail/Intermodal

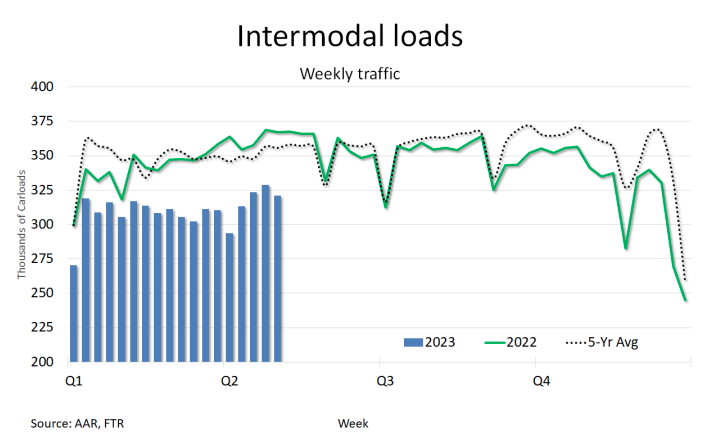

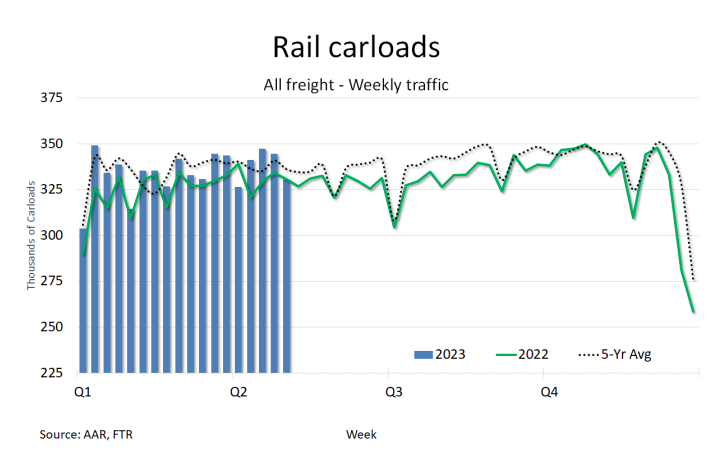

Intermodal and carload volumes declined in the latest week as volumes fell broadly in the first week of May. Nearly all of the specific carload groups were impacted, with the only ones not majorly impacted being those already operating at historically low levels like pulp and paper.

What remains to be seen is whether the decline is a one-week blip and traffic will bounce back right away or if the weaker volumes will stick around for an extended period and indicate a slowing manufacturing and consumer economy.

Most concerning this week is that economically sensitive freight declined significantly as well. These are the commodity groups excluding coal, agriculture, and petroleum, that are more closely tied to the underlying economy and the ones that will be responsible for volume growth going forward in 2023 and beyond.

Union Pacific, along with Canadian National and Grupo Mexico adjusted the service expectations for their joint cross-border intermodal service by shaving one day off the overall transit time for their product and CPKC announced the start of their Mexico Midwest Express with a daily train in each direction. The new services between the different carriers have the potential to increase cross-border shipments and raise the profile of Mexican ports of entry, but so far there has not been an appreciable change in the volumes.

Several lawsuits have been filed in response to the CPKC merger. The most notable is one filed by Union Pacific, with the railroad asking the federal appeals courts to undo or impose additional mitigation conditions on the CPKC transaction. UP asked the Surface Transportation Board for several mitigation measures to protect its access at the border as well as from operational impacts around Houston, Texas, but the agency granted none of their requests.

A group of Chicago-area neighborhood groups has also asked federal appeals courts to remand the approval decision back to the STB for reconsideration because of its lack of environmental conditions and mitigation around the expected increased train counts that will move through their communities under the combined carrier. The neighborhoods want the board to be required to complete an additional environmental impact statement that specifically addresses their interests.

Neither lawsuit likely will be successful, but the litigation adds uncertainty and risk until the cases are decided. The board’s final approval decision in March came with precious few conditions beyond what CPKC had voluntarily agreed to during the negotiation process.

See how your organization can capitalize on the power of actionable intelligence by clicking below: