As an economist with an engineering background, I tend to focus on the longer-term horizon for such questions. Both Tony Hatch and Larry Gross may be correct in their respective intermodal assessments already posted to Commtrex members. My outlook is tempered less by the restocking current market demand — adding to the forthcoming holiday stocking surge. I’m concerned by the longer running legs of a marathon when one considers two intermodal challenges.

1. One challenge is the question of eventually replenishing the TTX car fleet as and if the growth spurt continues — as identified by both colleagues.

- No orders are pending for stack well car replacements and no orders for perhaps “spine cars” to handle semi-trailers as TOFC business.

- As TTX and the Class I railroads work off the cars technically still in fleet surplus, the overall supply becomes a timing issue.

- UNLESS? Unless the PSR car cycle times are now so much better, that the fleet utilization is up by arguably 20% or more.

Is utilization up by that much?

Where’s the published evidence?

2. The second issue is one of the domestic 53-ft length container fleet. At some point, someone has to purchase more “domestic containers”.

So for the intermodal marathon run out towards late 2021 and into 2023-2025, my “marker” outlook is scanning for a CAPEX signal ... offset by some evidence of better operating use train set cycles.

And for domestic, the third challenge still has to be finding a means to profitably expand into the under 300-mile distance corridors. Why? Because that’s where the highway congestion is so prevalent.

For rail intermodal to be a more relevant national asset, its got to up its short-haul “game”.

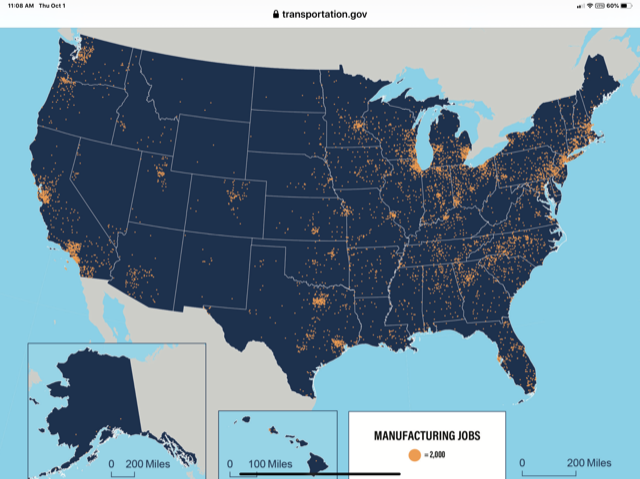

As this US DOT just released map shows, the traffic base for rail growth lies in serving the mass of manufacturing O/D locations east of the Mississippi River and north of Florida.