Bankruptcy, SME mergers, market exits – the dark road to sustainable transportation rates.

The market in 2023 is certainly presenting many challenges. Today we’ll look at the economics of a return to stable, sustainable market rates in primarily trucking. Unfortunately, as we face primarily a supply and demand issue, and interest rates don’t appear to be coming down anytime soon, the road isn’t pretty. A reduction of supply as trucks exit the market will be the first reason rates come back up.

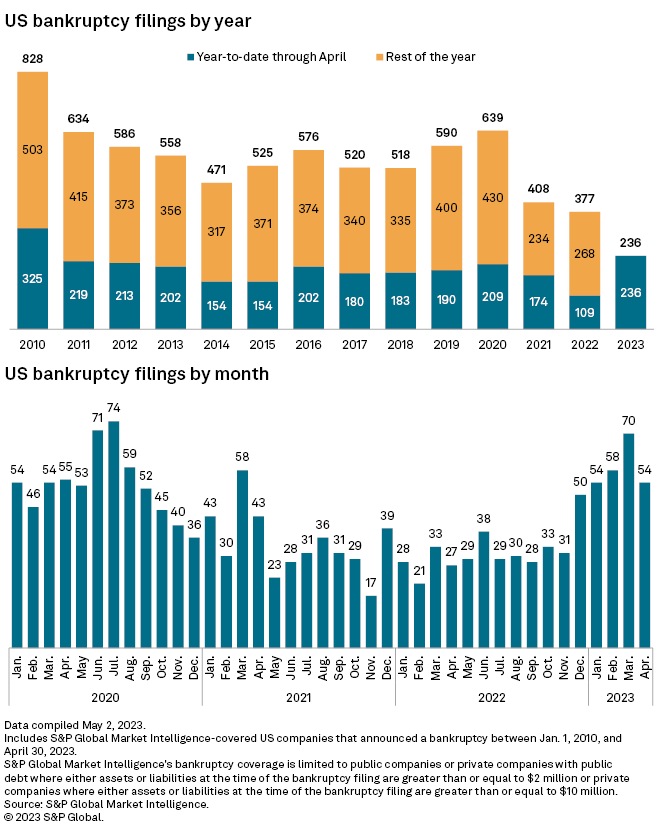

S&P Global Market Intelligence is reporting the highest number of corporate bankruptcy filings since 2010, and this news comes as of April - not even halfway through the year. See below graphic and article here.

In transportation, Freightwaves literally called it a ‘bloodbath’ for carriers in early 2023, as more than 9,000 trucking companies exited the market (see here). To date, notable bankruptcy news includes Tiger Cool Express LLC filing for bankruptcy and Yellow (the fifth largest trucking company in the USA) still reported to be on the brink of filing.

And while big company bankruptcies are making headlines, it’s important to remember that most of the trucking industry is still made up of small fleets and owner-operators. In a recent Freightwaves survey, 35.2% of owner-operators self-reported that they are considering leaving trucking if market conditions do not improve by the end of 2023. That’s a telling qualitative statistic of how our industry is feeling for drivers and carriers.

Then, there are the companies that are keeping their heads just above water. I have personally attended several insurance seminars hosted by both brokers and underwriters, and they are reporting other troubling behaviors. We’re hearing of carriers that are 3-4 months behind on their insurance payments and are having their coverage revoked. Brokers and shippers beware, not all carriers are simply ceasing their operations because their insurance isn’t in good standing. Some are continuing to operate without insurance. Vet insurance carefully in this challenging market, don’t assume paperwork received months ago is still good to go today.

Equipment suppliers in our industry are facing similar challenges. Some carriers cannot pay their monthly expenses, and the equipment supplier has no choice but to repossess their equipment. In these cases, the carriers are also forced out of the market, and at least not putting anyone at risk on the roads.

Regardless, of whether it is insurability, equipment, or flat-out bankruptcy forcing trucking companies out of the market in 2023, it is happening. Trucking companies are exiting, and truck supply is decreasing.

Next, more mergers are happening every month. As one example, Knight/ Swift has reunited and proceeded to purchase AAA Cooper and US Express for $2 Billion total. Small/Midsize Enterprises (SMEs) already fighting a tough market are ripe for acquisition by larger companies who are fairing better in today's market against the odds.

So how do fewer trucks and more mergers equal more sustainable rates?

Equilibrium.

Let’s lay this out piece by piece. Today, we have far more truck supply than demand, driving rates down. As all companies (large and small) face low rates, some will exit the market. Others will be forced out by bankruptcies, lack of insurance, or repossessed equipment. Now, mergers will also continue for struggling companies looking for a different way out. If SMEs continue to be acquired and 35.2% of owner-operators really do exit the market, larger conglomerates will become substantially more common in the trucking industry (a major shift). With fewer SMEs and a less saturated market, we’ll be seeing a far less competitive rate environment, once again driving rates north. Finally, with both oversupply of trucks and rate competition declining, rates will come back up.

The trouble is, we don’t know how long this will take, or how fast the rate swing will occur through fast market exits. Naturally, all transportation suppliers want rates to increase to sustainable levels. Nobody is looking for pandemic-inflated rates, but reducing volatility and a stable environment would be far better for everyone. It appears that this may happen, but it won’t be an easy ride, and many companies will struggle to be one of the companies left operating to see normal, stable rates.

See you next week!

Bill Robinson

If you’re looking for basics on trucking, check out our Trucking 101 lessons using the link below!