Rachael McMunn is the Director of Marketing at Wellington Group of Companies. Regular readers are aware Rachael is instrumental in wordsmithing all articles for the Shipper report. Rachael is not like other marketing people I have worked with in transportation, her understanding of our industry makes her unique. In addition to this great point of view, I also pasted a hyperlink on a piece Rachael developed for our international division at the end of her article today.

Hope you enjoy Rachael’s article.

See you next week!

Bill Robinson

Retail Shippers don’t think consumers are ready to spend this holiday season – And they’re probably right.

It can be hard to understand what’s going on in the North American economy right now. On one hand, some people seem to be richer than ever. On the other, people (especially people on fixed incomes) are experiencing a decaying lifestyle as inflation climbs.

As a Millennial without a particular business background, I tend to get lost in all of the economic forecasting out there. Still, I like to be economically savvy. I’m a homeowner, so I care about interest rates. I’m also a big fan of having a 5-year investment plan, so I like to dabble in a little bit of predicting the future from time to time as well.

Since I get to spend most of my day around some very bright supply chain minds, I’ve developed a habit of using freight volumes as indicators of major economic trends. Different volumes often show me different things, and many are related to consumer spending, one of the most important economic indicators.

In relation to the holiday season, I was interested in seeing what shippers were predicting for consumer spending. This forecasting (that shippers spend millions trying to get right) is not often something they simply come out and tell the general public. Still, there are red flags in a shipper’s activity that might reveal what their expensive forecasting is telling them about the economy and consumers.

This year, a red flag comes in the form of low international freight volumes. Numbers published by the Intermodal Association of North America (IANA) show a year-over-year drop in international freight volume by roughly 15.4% in the third quarter of 2023

What is this YOY reduction evidence of?

North America relies significantly on imported goods for many retail products as manufacturing still typically lies offshore – despite the USA encouraging more on-shore shippers using more near-shoring and local production. Further, many of the products that come from overseas are the ones that make popular gifts during the holidays. The shortage of containers making their way over to North America as we head into the holiday season tells us a lot about what major retailers are forecasting when it comes to consumers purchasing their products.

It appears retailers are not being bullish with their sales targets, and they don’t want to overstock.

The underlying truth here is that retailers are looking at the upcoming holiday season quite conservatively, and they have every right to. Interest rates and the cost of borrowing continue to be a challenge. Both Canada and the USA are still looking at no relief from rate hikes in the near future. The average Joe probably isn’t looking at Christmas this year with excitement to spend. I know I’m not! As we move further down the line of rate hikes, the pressure on consumers is mounting. These shippers’ actions do make logical sense.

For carriers and brokers – shippers are still planning to be weathering a storm next year and you should be too. While we should all be seeing a peak season in the market like in previous years (though admittedly not as peak as COVID-19 years), it is looking more like we might even see a valley.

How significant of a choice (by shippers) is it to accept forecasting of low holiday sales and ship less?

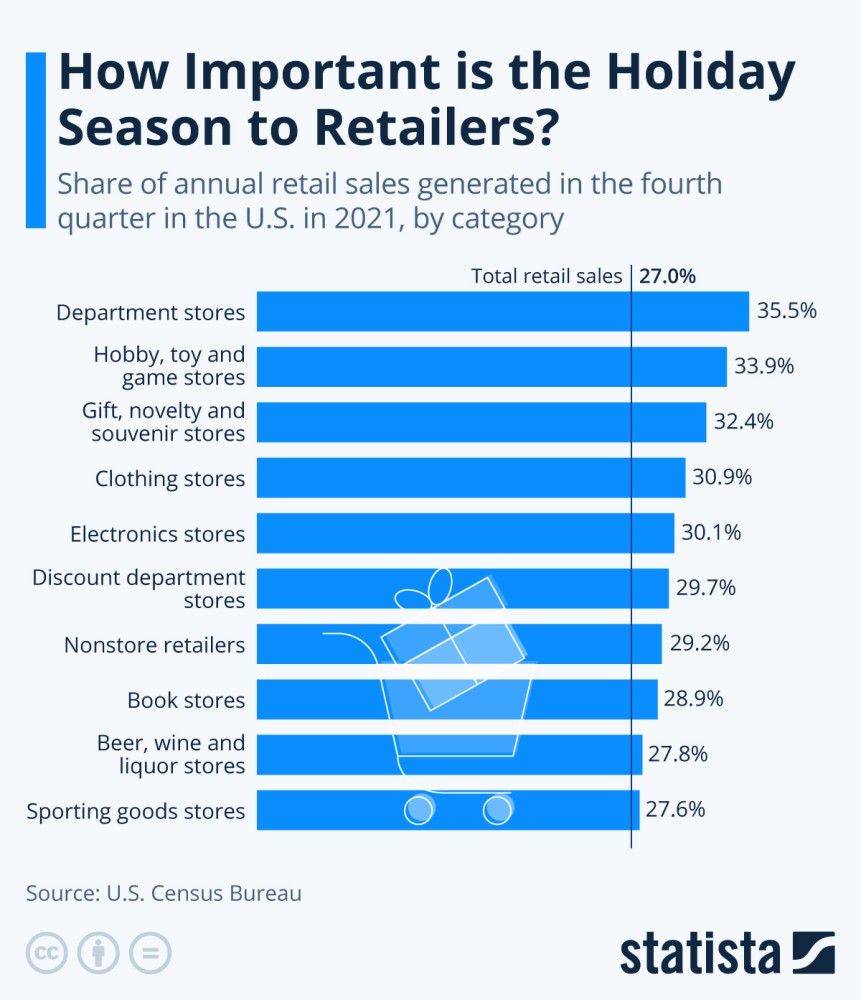

If the annual revenue for a shipper was divided evenly, then each quarter should represent 25% of their total annual revenue. For shippers moving freight internationally AND heavy holiday sellers (such as department stores, toy stores, clothing stores, and electronics) the percentage of revenue in Q4 can be much higher than 25%, with some inching over 35% of their total revenue in those few months.