Hoping for the best is not a good risk management strategy for rail operations. Neither is avoiding all business opportunities that come with risk.

Taking a more realistic and comprehensive approach to identifying, prioritizing, and managing risk is the realm of Enterprise Risk Management (ERM). “Think of Enterprise Risk management as an exercise program for risk. It’s not always what you want to do when you wake up in the morning, but you are always glad that you did it,” says Lisanne Sison, managing director of the ERM Practice for Arthur J. Gallagher Risk Management Services.

At the heart of all risk lies uncertainty – the outcome of any particular risk-reward equation could be either good or bad. ERM seeks to tip the scales of the sum of all risks in the favor of that company.

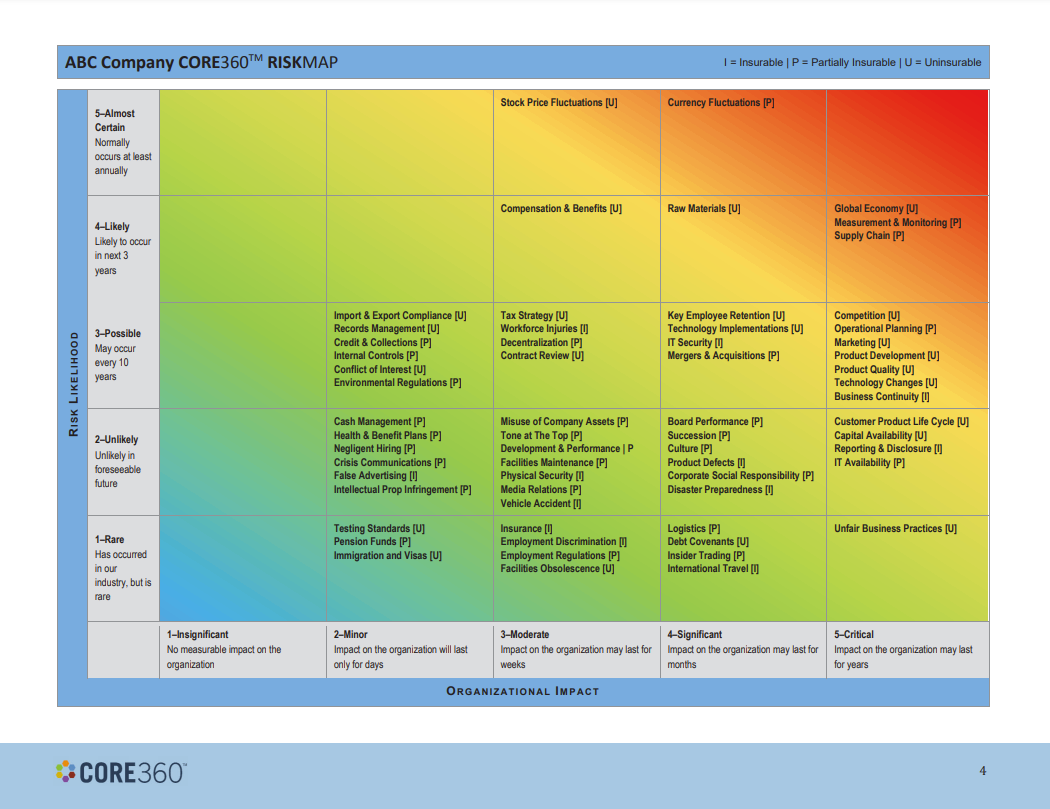

ERM aims to measure risk on a company-wide basis with the same measuring stick and plan for the best possible risk management strategy for each risk within given budget constraints. Insurance is one way to approach those risks, but not always the only or best way, given the realities of the insurance market.

For railcar owners or rail operators, having the right protocols to inspect and maintain physical assets (such railcars, track, safety appliances, and equipment) are central to risk management. Meanwhile, safety policies and procedures that are periodically tested are crucial to employee safety. Having good contract language is critical to understanding where the risks of the enterprise end and those of the companies it does business with start.

While those strategies to avoid and mitigate risks are important, it’s often necessary to add a layer of insurance on top of them. For instance, a railcar owner will typically insist a lessee is insured for damage to the leased railcar (rolling stock coverage); depending on the value of the rail freight, it may be important to insure against damage to it (bill of lading coverage). If the freight is toxic, hazardous, or explosive an environmental/pollution policy can help address any remediation or liability caused if it is spilled.

To protect from the risks inherent in hauling freight and operating its rail network, railroads usually have specialized railroad insurance policies. Contractors and transloaders who work around tracks have railroad protective insurance policies.

These and other rail-specific policies can be considered on top of the coverages that businesses typically have, such as general liability, professional liability, workers compensation, and auto liability.