Heavy freight. Long trains. High horsepower. Flammable and hazardous materials. There isn’t much room for error when handling rail freight. When something goes wrong, the toll in property damage, injury, and possibly, death can be terrible.

“There is no such thing as a small claim when it comes to rail accidents,” says Kevin Woods, national director of the rail practice for insurance broker Arthur J. Gallagher Risk Management Services. The mentality is that anybody involved in rail shipping has deep pockets and can pay the claims. That’s why all businesses involved in rail freight must have a thorough understanding of their risks and find the best ways to avoid, reduce, or transfer them with a risk management and insurance program.

Meanwhile, liability costs are high and rising. It’s a phenomenon known as “social inflation,” where increased litigation, higher jury awards, and new concepts of negligence lead to mounting insurance losses.

A study commissioned by the U.S. Chamber Institute for Legal Reform found that commercial tort liability stands at $343 billion per year, an increase of 12% when compared to a study it completed two years earlier.[1]

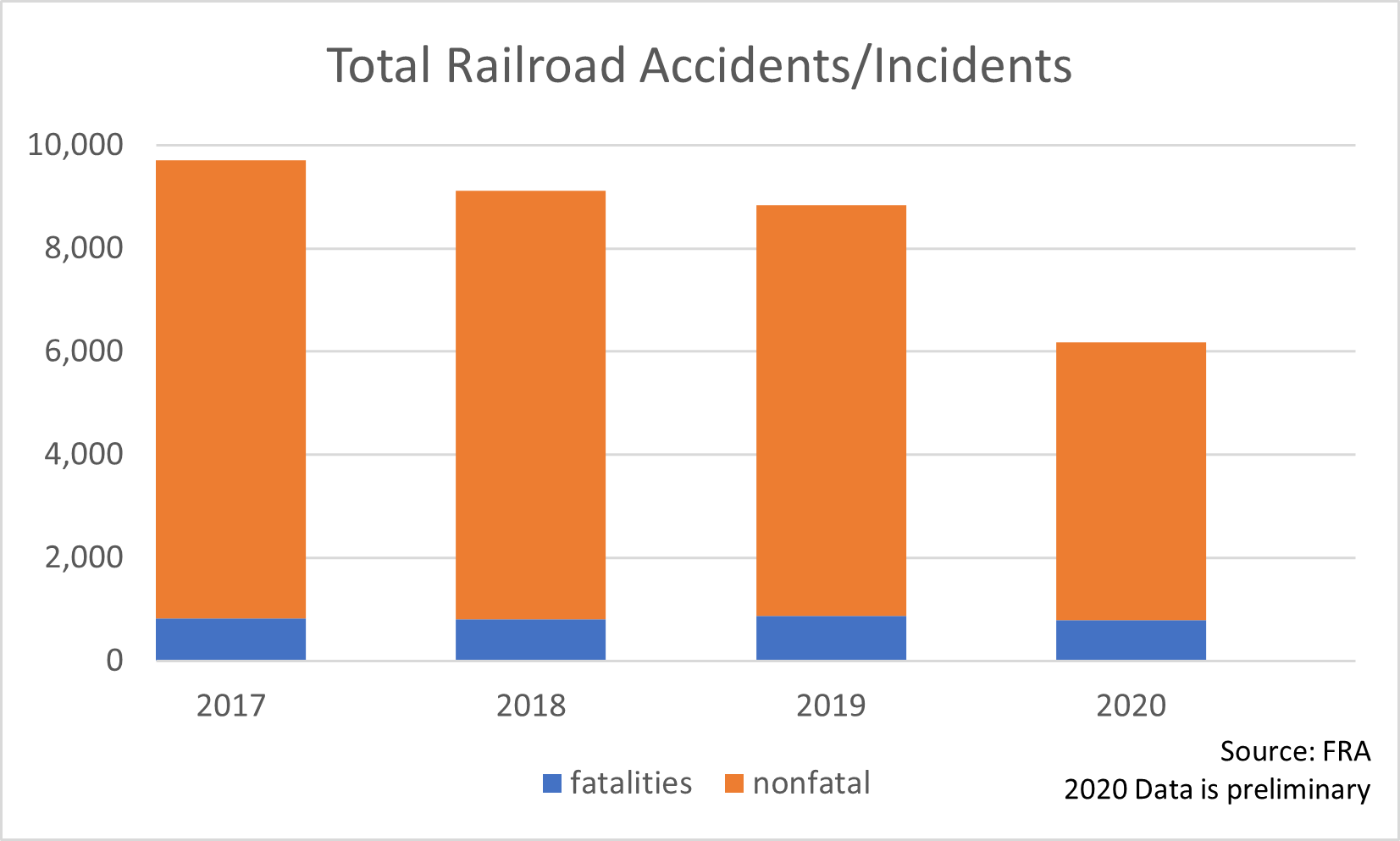

The rail industry is doing its part to reduce risk. The American Association of Railroads reports that since 2000, train accident and hazmat accident rates are down 30% and 64%, respectively, while rail employee fatalities in 2019 matched an all-time low.

Despite those headways, many rail-related businesses have problems finding cost-effective insurance, according to Woods. “There are only a few that will write this type of coverage, that truly understand the risk of a rail shipper.” Finding an underwriter and broker who will dig into the details of the rail operations and collaborate on mitigating risk is an essential task for rail-related companies seeking to manage their risks.

Graph- Insurance Coverages for Rail-Related Businesses:

- Auto Liability (including hi-rail vehicles)

- Contingent Railroad liability

- Contractors general liability

- Crime/theft/vandalism

- Equipment liability

- Railroad Liability

- Railroad Protective Liability

- Passenger liability

- Professional liability

- Workers compensation

- Commercial property & inland marine

- Bailee & warehouseman

- Track & roadbed

- Bridge & tunnels

- Equipment & rolling stock

- FELA

- Bill of lading

- Evacuation & evacuation expenses

- Environmental/Pollution

- Cyber liability